The US stock market showcased notable resilience last week, despite the release of inflation data on August 14. The Year-to-Year inflation value saw a slight decrease, while other indicators remained unchanged. Interestingly, the market did not exhibit any significant reaction to this news, suggesting that investors may have already priced in these expectations or are focusing on other economic factors.

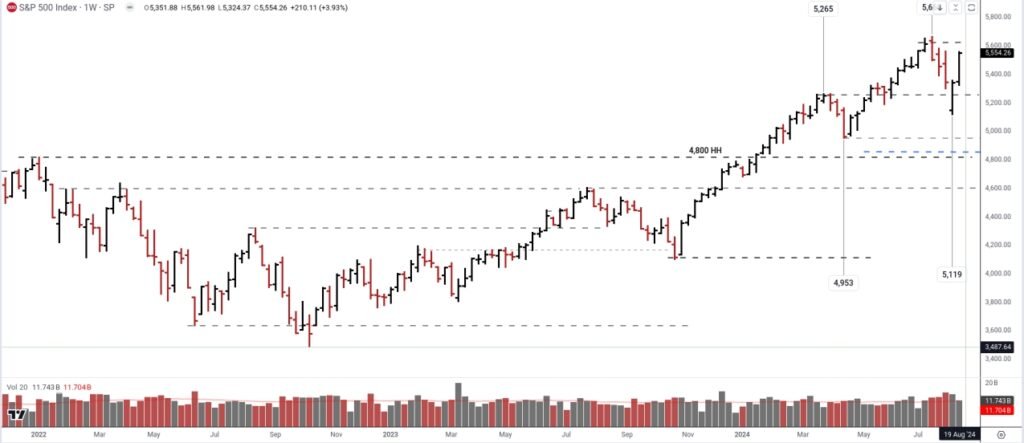

SPX Index Nearing All-Time High

The SPX index, a key benchmark for the US stock market, closed the week nearing its all-time high (ATH) of 5,670. This is a significant recovery, as it has reached the level where a previous sell-off began earlier in August. The rally that started post-sell-off has continued to gain momentum, indicating strong market sentiment. Investors are now closely monitoring whether sellers will reappear at this critical level, which could potentially halt the rally. The market’s performance in the coming days will be crucial in determining if the SPX can push past its previous highs or if another wave of selling pressure will emerge.

NDX and Sector ETFs

The NDX also reached a key level at 19,500, where the last sell-off started. This level is crucial for the tech-heavy index, and its performance here will be closely watched. Among sector ETFs, XLK mirrors the NDX’s performance, indicating a strong tech sector. XLF (Financials) and XLI (Industrials) have been among the strongest performers over the last two weeks, almost erasing the losses from the sell-off that began on August 1. On the other hand, XLE (Energy) appears weaker compared to other sectors, with oil prices closing at the same level as the previous week.

Commodities: Gold and Silver

In the commodities market, gold has made headlines by reaching a new ATH this week, continuing its upward trend. This surge in gold prices is being closely watched to determine if it is sustainable in the long term. Alongside gold, silver is also starting to gain momentum, indicating a broader interest in precious metals. Stocks like AEM (Agnico Eagle Mines Limited) and KGC (Kinross Gold Corporation) are showing promise, likely benefiting from the bullish sentiment in the gold market.

Dollar Weakness and Market Implications

The USDEUR closed the week down and is starting to look more bearish, confirming a lower low since the beginning of March 2024. This dollar weakness might have helped the stock market to stay bullish. A weaker dollar generally makes US exports more competitive and can boost corporate earnings, which in turn supports higher stock prices.

Conclusion

In summary, the US market is currently in a phase of strong recovery and resilience. The SPX index’s approach to its ATH and the bullish trends in gold and silver are key indicators to watch. Investors should stay vigilant as the market navigates these critical levels, which will likely set the tone for future movements. The interplay between sector performance, commodity prices, and the dollar’s trajectory will be crucial in shaping the market’s next move.

Best Regards.